Commercial invoice is an extremely important document in international import and export. It illustrates the purchase price and the selling price of the products. Suppliers must have this document to specify how much the buyer shall pay and to establish the customs value used to calculate the import tax price. What then is a commercial invoice? What does a commercial invoice do and what does it contain? Visit Infinite in the following article to learn more information.

The Definition and function of Commercial Invoice

Definition

Commercial invoice, or CI, is a document used to exchange payments for the value of commodities between an exporter and an importer. This is an important document in the foreign trade industry and equally important in the customs dossier.

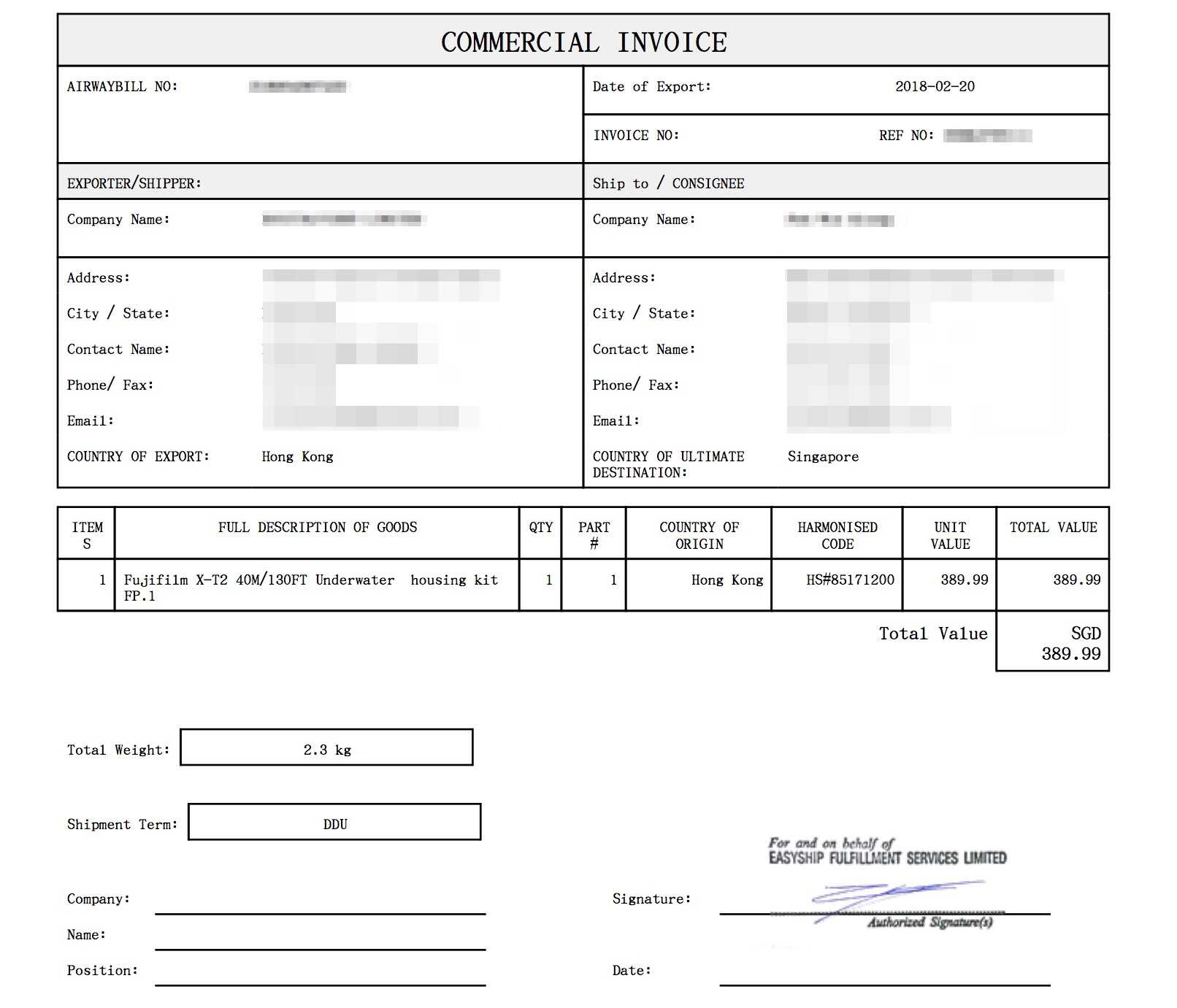

The main contents of the commercial invoice include:

- Invoice number and date.

- Name and address of seller and buyer.

- Commodity information: quantity, description, unit price, amount.

- Delivery conditions.

- Payment conditions.

- Name of port of loading and unloading.

- Vessel name, trip number, …

Function

- Used for payment between seller and buyer, exporter and importer of goods.

- Commercial Invoice is used as the basis for calculating import and export taxes

- The basis for comparing the information with other documents during the contract performance by the parties as well as the implementation of related import and export procedures. Cross-referencing this document with the relevant information on the packing list, notice of arrival, and bill of lading is crucial and absolutely necessary. If there is a discrepancy, the document witness or customs declarant must immediately check and, if necessary, supplement and correct the data

Contents of Commercial Invoice

After you understand what a commercial invoice is, below we will share with you the contents of the Commercial Invoice. The commercial invoice will have to fully show the following contents:

1. Buyer (Buyer/Importer): Includes basic information such as company name, address, email, phone number, fax, representative, depending on payment conditions will include bank account information of the importer

2. Seller (Seller/Exporter): Same as buyer

3. Invoice number: A valid abbreviation specified by the exporter

4. Invoice date: According to international business practice, usually an invoice is made after the contract is signed by the parties and before the date of goods export (Bill of Lading) to match the set of export documents.

5. Terms of Payment: can name some of the following popular methods: T/T, L/C, D/A, D/P.

– T/T is perhaps the most popular due to its simplicity of use, speed, and convenience; yet, it carries risk for the exporter (at the greatest level compared to other payment methods). It is preferable to avoid using this method if the seller is seriously concerned that there is no obligation to bind the customer to pay after receiving the goods.

– Less frequently used is L/C (documentary credit payment), essentially reducing the risk for exporters. The TTR method is fundamentally different from T/T (T/T: wire transfer – the buyer transfers money directly to the seller’s account; while TTR is merely a form of money transfer, it is used in L/C)

– As for D/A and D/P (method of payment by collecting documents): Ensure almost maximum safety for the seller, but it is quite complicated and cumbersome when the documents have to be checked, compared and confirmed between the parties no less than 2 times. When using this method, it can be seen that the trust between the seller and the buyer is not really great.

6. Commodity: On Commercial Invoice it is quite general, mainly the name of the goods, the total weight (gross weight), the number of blocks (measurement), the number of pieces in bags/boxes/cartons… respectively and the total amount to be paid. For more complete details, you should see the goods information on the Packing List, bill of lading or C/O (if any).

7. Amount: The total value of the invoice, usually in both numbers and words, along with the face value of the payment currency.

8. Incoterms: Usually listed with a certain location (eg CIF Hai Phong, Vietnam). It should be noted, because the amount on Invoice is not always 100% of the factory sale price. Each Incoterms condition corresponds to the responsibility of the buyer and the seller, the more responsibility the seller has, the higher the price on Invoice is than the ex-factory price. For instance, the CIF price is typically greater than the FOB price since it includes charges for insurance, sea freight, and exports in addition to the price of the products (you should pay attention to this detail when making the import customs declaration).

Besides, there are some other common information: POL (port of loading), POD (port of discharge), Vessel/Voyage (name of ship/trip number), Destination (often coincides with POD)…

Commercial Invoice and Letter of Credit

For shipments paid in the form of documentary credit (L/C), the contents of the Commercial Invoice must comply with the requirements of UCP 600. The content is as follows:

- Invoice maker must be the seller (if using the method of collection, money transfer, …), in the invoice, the beneficiary’s name stated on the L/C if documentary credit is used.

- Invoices are made to the buyer or the person opening the letter of credit.

- Invoices must correctly state the name of the seller, the buyer in the contract or in the L/C.

- Commercial invoice does not need to be signed, if signed, it must be clearly stated in the L/C.

- The L/C must be consistent with the description in the invoice for any services and transactions.

- The invoice must include information referred to in the L/C regarding purchase orders, notices, or import licenses of other buyers.

- The invoice’s details must correspond to those in other documents.

- If the goods are not paid by L/C, the above requirements are not required.

Some common mistakes to avoid in Commercial Invoice

There are numerous businesses that perform Commercial Invoices as part of customs services, and they frequently make some critical errors. These errors are often caught by customs and affect the customs clearance process of goods as follows:

- The invoice does not specify delivery conditions such as FOB (enclosed with the name of the port of export), or CIF (with the name of the port of entry).

- The exporter follows the CIF price (shipping price) but the invoice only shows the FOB price at the place of loading and unloading, and also does not mention other costs.

- The shipper offers a discount, but the invoice simply displays the total amount actually paid, not the discount percentage.

- The item description of the goods is not clear, there may be some other information missing, and many items are grouped into the same category, etc.

With the detailed content of Commercial Invoice that we have presented in the above article, customers will surely accumulate basic knowledge for their work.